Jason Smith, Ways and Means Chairman, has taken to the media to start stumping and communicating priorities and positions for the eventual tax bill coming from Congress.

Here are a few things I’ve heard consistently throughout the final week of January.

1. Pass the bill.

Jason absolutely stressed his critical awareness of how slim the Republican House majority is. To his point, when the TCJA passed, they lost thirteen republicans. Today, they can’t lose one. He’s also clear that two different reconciliation bills and budget resolutions would be nearly impossible.

2. Get it out quickly.

Congressman Smith wants to present the bill early, to make felt the effects of its passage and benefits of economic certainty. He feels the 2017 tax reform was too slow and hampered their chances in the 2018 midterms. To this end, he’s shooting for an incredibly optimistic Memorial Day release.

3. Permanentize the High Standard Deduction

The standard deduction (or as it is sometimes referred to as the “Guaranteed Deduction”) is scheduled to be slashed by 50%. Jason has made it clear that the top tax priority is to extend that at the very least.

4. Preserve a State-and-Local-Tax Deduction Cap

Jason implied the SALT cap is here to stay to some degree, despite Trump’s musings. The President signaled early support for a renewed unlimited SALT deduction[1], but it’s not been reiterated like other tax promises such as “no tax on tips.” This dichotomy between what the Congressman and President are saying highlights the realities and difficulties of producing effective legislation. The reality is that uncapping these deductions can significantly alter the federal revenue, which will impact other budget items. It is likely that there will be some compromise on this.

5. Maintain a High Estate Tax Exemption.

While this has never been a hot-ticket item for public appeal, Jason expressed significant disfavor of increasing the “Death Tax.” He explained that several of his constituents are cotton farmers, operating family farms on average of 1500 acres. At $10,000/acre for marketable farmland, letting the TCJA estate tax expansion lapse could significantly impact Jason’s home district. That could be lip-service, but the reality is that the estate tax makes up less than 1% of federal revenue, and congress favors high estate exemptions for both personal interests and patronage. The support itself is not the shock, but the sharp contrast from previous bills that proposed an altogether elimination of the estate tax last year.[2]

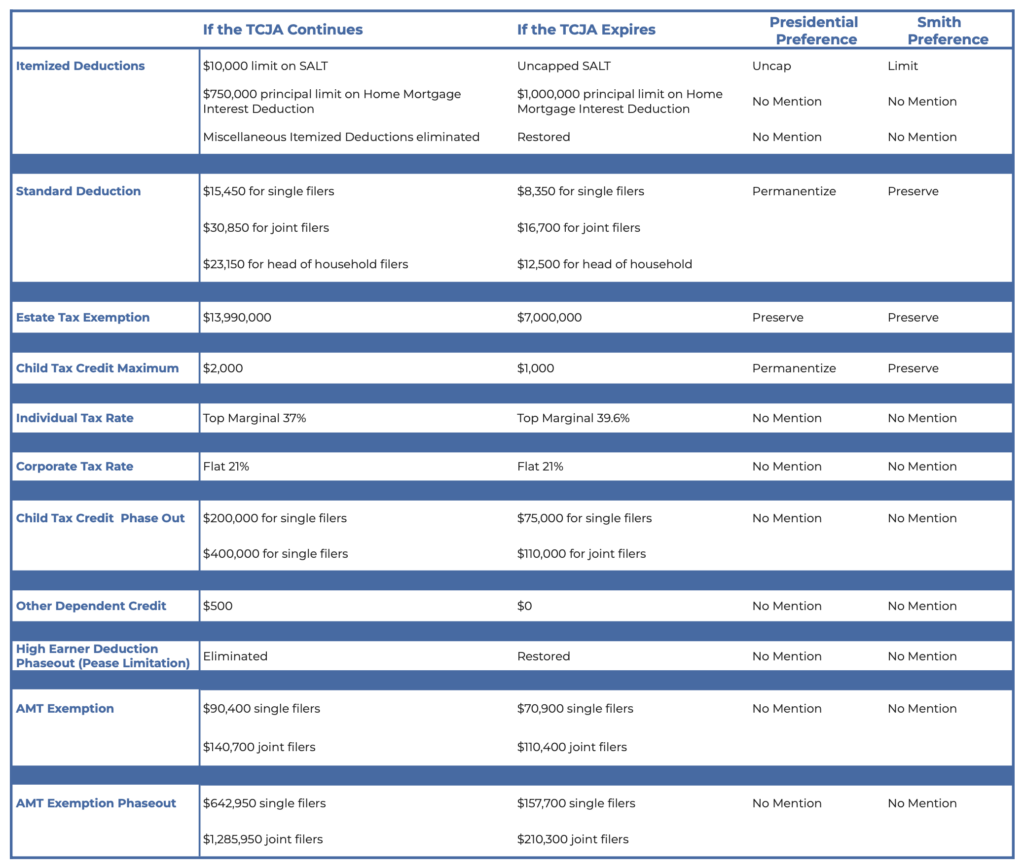

This chart summarizes the 2017 tax cuts, the expiring provisions, and Trump and Smith’s priority list for the new bill.

Things You Can Do Now:

- Review your tax deductions and credits: Make sure you’re maximizing available deductions (e.g., mortgage interest, charitable contributions, retirement contributions).

- Evaluate your estate planning documents: Review your will, trust, and power of attorney. Consider updating them if there have been significant life changes (marriage, children, etc.).

- Check your retirement savings: Assess whether you’re on track with contributions to your 401(k), IRA, or other retirement plans. Consider the tax implications of your contributions.

- Plan for capital gains: If you’ve sold investments or property, determine whether any capital gains taxes might apply and plan accordingly.

- Consider Tax Structure of Your Business: Owners of different tax entities (Partnerships and S Corps) may want to consider converting to a C corporation if that is a more tax-effective entity structure. See our considerations for S Corps here.

- Review your withholding: Check if you’re withholding the right amount from your paycheck based on your current tax situation. Adjust if necessary to avoid under- or over-paying at tax time. Think about what your withholding and income needs look like in the event of a higher tax rate.

- Consider tax-loss harvesting: If you have investments in taxable accounts, explore tax-loss harvesting to offset gains.

- Look into tax-advantaged accounts: Make sure you’re taking full advantage of HSA, FSA, and other accounts that offer tax benefits.

- Schedule a Consultation: Schedule a meeting to review your financial situation and ensure you’re on track for the current year’s taxes. If you don’t have a CPA, start looking into hiring one.

This post is for informational purposes only and does not constitute or contain tax or legal advice.

[1] https://www.taxnotes.com/featured-news/trump-calls-lifting-salt-cap-tcja-tops-johnsons-2025-list/2024/09/17/7lm6v

[2] https://www.cnbc.com/2024/01/19/house-republicans-reintroduce-bill-to-repeal-death-tax.html